IRSC Calendar 2024-2025: Navigating the complexities of tax compliance requires a agency grasp of key deadlines. This calendar serves as an indispensable information for people and companies alike, outlining essential dates for tax submitting, funds, and different IRS-related obligations. Understanding this calendar is paramount for efficient tax planning and minimizing potential penalties.

This complete information particulars the numerous dates for each particular person and enterprise taxpayers, providing methods for proactive tax planning and highlighting the potential penalties of missed deadlines. We’ll discover the nuances of the IRS calendar, evaluating deadlines for various enterprise constructions and offering assets to remain up to date on any adjustments.

Understanding the IRS’s Calendar Significance: Irsc Calendar 2024-2025

The IRS calendar performs a vital position in each tax planning and compliance for people and companies. Understanding key deadlines and tax kind necessities is important for avoiding penalties and making certain easy tax submitting. Cautious consideration to the IRS calendar permits for proactive tax administration, minimizing potential points and maximizing tax advantages.

Key Dates and Deadlines for People and Companies

The IRS calendar is stuffed with necessary dates that have an effect on taxpayers. These deadlines range relying on whether or not you’re a person or a enterprise, and understanding these variations is paramount. For people, the first deadline is usually April fifteenth, whereas companies typically have totally different submitting deadlines relying on their construction and accounting strategies. Lacking these deadlines may end up in penalties and curiosity prices.

Due to this fact, proactive planning and correct record-keeping are important.

Tax Varieties and Their Due Dates, Irsc calendar 2024-2025

Quite a few tax kinds are used for varied tax conditions. Some widespread kinds for people embrace Kind 1040 (U.S. Particular person Earnings Tax Return), Kind W-2 (Wage and Tax Assertion), and Kind 1099 (Miscellaneous Earnings). Companies could use kinds like Kind 1120 (U.S. Company Earnings Tax Return), Kind 1065 (U.S.

Return of Partnership Earnings), and varied different kinds relying on their particular enterprise construction and actions. Every kind has its personal particular due date, and it’s crucial to file the right kinds by their respective deadlines. Failure to take action can result in important penalties.

Planning your yr with the IRSC calendar 2024-2025? Bear in mind to consider private break day, maybe for a calming getaway. In the event you’re contemplating a cruise, you may discover some nice choices by testing cruises 2025 from baltimore md to see if any coincide along with your schedule. As soon as you have finalized your trip plans, you’ll be able to seamlessly combine them into your IRSC calendar 2024-2025 for a well-organized yr.

Key IRS Deadlines for 2024 and 2025

The next desk Artikels key deadlines for each particular person and enterprise filers. Be aware that these dates are topic to alter, and it is essential to seek the advice of the official IRS web site for essentially the most up-to-date data. All the time confirm these dates yearly to make sure compliance.

| Class | Deadline 2024 | Deadline 2025 | Description |

|---|---|---|---|

| Particular person Earnings Tax | April 15, 2024 | April 15, 2025 | Submitting deadline for Kind 1040 |

| Estimated Tax Funds (People) | April 15, June 15, September 15, January 15 | April 15, June 15, September 15, January 15 | Quarterly funds for self-employed people and others |

| Company Earnings Tax | March 15, 2024 | March 15, 2025 | Submitting deadline for Kind 1120 |

| Partnership Earnings Tax | March 15, 2024 | March 15, 2025 | Submitting deadline for Kind 1065 |

Influence of the IRS Calendar on Taxpayers

The IRS calendar considerably impacts taxpayers, dictating essential deadlines for submitting returns, paying taxes, and profiting from varied tax advantages. Understanding this calendar shouldn’t be merely helpful; it is important for navigating the tax system successfully and avoiding doubtlessly critical penalties. Failure to stick to the IRS’s schedule can result in penalties, curiosity prices, and even authorized repercussions.

Planning your yr with the IRSC calendar 2024-2025? Bear in mind to consider private journey, particularly should you’re contemplating a Disney cruise. Discovering out when Disney will launch their 2025 cruise dates is essential for reserving, so verify this beneficial useful resource: when will disney release 2025 cruise dates. Upon getting these dates, you’ll be able to seamlessly combine them into your IRSC calendar 2024-2025 for an entire overview of your yr.

Proactive tax planning, knowledgeable by the IRS calendar, permits taxpayers to optimize their tax legal responsibility and reduce their threat.The IRS calendar’s affect extends past merely figuring out when to file. It offers a framework for strategic tax planning all year long. By understanding the deadlines and necessities, taxpayers can higher handle their earnings and bills, doubtlessly lowering their total tax burden.

Planning your yr with the IRSC calendar 2024-2025? Bear in mind to consider private journey, particularly should you’re contemplating a Disney cruise. Discovering out when Disney will launch their 2025 cruise dates is essential for reserving, so verify this beneficial useful resource: when will disney release 2025 cruise dates. Upon getting these dates, you’ll be able to seamlessly combine them into your IRSC calendar 2024-2025 for an entire overview of your yr.

This proactive method helps shift the main target from reacting to deadlines to strategically planning for them, resulting in larger monetary management.

Penalties of Lacking IRS Deadlines

Lacking IRS deadlines may end up in a spread of penalties and curiosity prices. For instance, failing to file a tax return by the deadline will sometimes incur a penalty calculated as a proportion of the unpaid tax. Late fee penalties are additionally widespread, typically accruing curiosity from the due date till the tax is totally paid. In additional critical circumstances, intentional disregard for deadlines can result in extra important penalties and even authorized motion from the IRS.

The particular penalties and rates of interest are topic to alter and depend upon components resembling the quantity of tax owed and the rationale for the delay. It’s essential to seek the advice of the IRS web site or a tax skilled for essentially the most up-to-date data.

Planning your occasions for the IRSC calendar 2024-2025? Take into account including important dates like main sporting occasions. For example, you may need to observe the dates for the world transplant games 2025 , a very inspiring competitors. Returning to the IRSC calendar, bear in mind to consider ample time for scheduling and preparation to keep away from conflicts.

Methods for Efficient Tax Planning Based mostly on the IRS Calendar

Efficient tax planning includes using the IRS calendar to anticipate and put together for upcoming tax obligations. This might embrace setting apart funds all year long particularly for tax funds, making estimated tax funds on time, or adjusting withholding out of your paycheck to align along with your anticipated tax legal responsibility. For example, self-employed people can use the quarterly estimated tax fee system, guided by the IRS calendar, to keep away from a big tax invoice on the finish of the yr.

This prevents the stress and potential penalties related to a big tax legal responsibility that will not have been correctly budgeted for. Moreover, understanding the deadlines for tax credit and deductions permits taxpayers to make the most of these alternatives to cut back their total tax burden.

Examples of Avoiding Penalties by Understanding the IRS Calendar

Take into account a taxpayer who’s self-employed and understands the quarterly estimated tax fee deadlines Artikeld within the IRS calendar. By making well timed funds all year long, they keep away from penalties related to underpayment of estimated taxes. Equally, a taxpayer who’s conscious of the annual tax submitting deadline can guarantee they submit their return on time, stopping late-filing penalties. One other instance may very well be a taxpayer who proactively gathers all mandatory tax paperwork nicely earlier than the submitting deadline, avoiding last-minute scrambling and potential errors that may result in delays and penalties.

Understanding the IRS calendar permits for proactive preparation and helps stop widespread errors that always end in penalties.

Proactive Steps to Meet Deadlines

Proactive steps are essential for assembly IRS deadlines.

- Mark necessary tax dates on a calendar.

- Arrange automated funds or reminders for estimated taxes.

- Collect all mandatory tax paperwork nicely upfront of the submitting deadline.

- Seek the advice of a tax skilled for customized steering.

- Repeatedly verify the IRS web site for updates and bulletins.

IRS Calendar and Enterprise Tax Obligations

The IRS calendar considerably impacts companies of all sizes, dictating essential deadlines for tax filings and influencing monetary planning. Understanding these deadlines and their implications is important for sustaining compliance and making certain easy monetary operations. This part will examine and distinction tax obligations for various enterprise constructions, establish key tax kinds and their due dates, and display how the IRS calendar immediately impacts enterprise budgeting and monetary planning.

Tax Deadlines: Firms vs. Sole Proprietorships

Firms and sole proprietorships, whereas each enterprise constructions, face distinct tax submitting necessities and deadlines. Firms, as separate authorized entities, sometimes file Kind 1120, U.S. Company Earnings Tax Return, by the fifteenth day of the fourth month following the top of their tax yr. Sole proprietorships, however, report their enterprise earnings and bills on Schedule C (Kind 1040), Revenue or Loss from Enterprise (Sole Proprietorship), which is filed with their particular person earnings tax return (Kind 1040) by the tax submitting deadline for people, sometimes April fifteenth.

This distinction in deadlines stems from the differing authorized constructions and reporting necessities. Extensions can be found for each, however the underlying deadlines stay crucial benchmarks.

Related Enterprise Tax Varieties and Due Dates

A number of tax kinds are related to companies, relying on their construction, actions, and monetary scenario. For instance, Kind 1065, U.S. Return of Partnership Earnings, is utilized by partnerships, whereas Kind 1041, U.S. Earnings Tax Return for Estates and Trusts, is utilized by estates and trusts. These kinds, together with their related schedules and kinds, typically have totally different due dates than particular person tax returns or company returns.

For instance, Kind 1065 often has a March fifteenth deadline for partnerships with a calendar yr, and Kind 1041 sometimes has an April fifteenth deadline. Correct understanding of those deadlines is paramount to avoiding penalties. The IRS web site offers a complete listing of all enterprise tax kinds and their related due dates.

Planning your yr with the IRSC calendar 2024-2025? Bear in mind to consider private journey, particularly should you’re contemplating a Disney cruise. Discovering out when Disney will launch their 2025 cruise dates is essential for reserving, so verify this beneficial useful resource: when will disney release 2025 cruise dates. Upon getting these dates, you’ll be able to seamlessly combine them into your IRSC calendar 2024-2025 for an entire overview of your yr.

IRS Calendar’s Influence on Enterprise Budgeting and Monetary Planning

The IRS calendar immediately impacts a enterprise’s budgeting and monetary planning course of. Companies should consider estimated tax funds all year long, primarily based on their projected earnings and bills. These quarterly funds, often due on April fifteenth, June fifteenth, September fifteenth, and January fifteenth, assist companies keep away from penalties for underpayment. Correct forecasting of earnings and bills is crucial to make sure enough funds can be found for well timed tax funds.

Failure to correctly account for tax obligations can result in money circulation issues and doubtlessly hinder enterprise development. Moreover, the annual tax submitting deadlines considerably affect the timing of year-end monetary reporting and the preparation of monetary statements.

Enterprise Tax Submitting Flowchart

The next flowchart illustrates the everyday steps concerned in submitting enterprise taxes, referencing related dates from the IRS calendar (assuming a calendar yr for simplicity):[Diagram Description: A flowchart would be visually represented here. The flowchart would begin with “Year-End Business Operations,” leading to “Gather Financial Records” (October – December). This would branch to “Prepare Tax Forms” (January – March), which then leads to “Calculate Estimated Tax Liability” (March).

From “Calculate Estimated Tax Liability,” one branch leads to “Make Estimated Tax Payments” (April 15th, June 15th, September 15th, January 15th), while another branch leads to “File Tax Return” (April 15th or relevant deadline based on business type). The flowchart concludes with “Record Tax Payments and File Confirmation.” Specific tax forms (e.g., Form 1120, Schedule C, etc.) could be indicated at the appropriate stages.]

Modifications and Updates to the IRS Calendar

The IRS calendar, whereas typically constant, is topic to occasional revisions. These adjustments can stem from varied components, together with legislative updates, technological developments, and unexpected circumstances. Understanding these potential shifts is essential for taxpayers and companies to precisely plan their tax obligations. This part will discover anticipated adjustments for the 2024-2025 tax yr and supply assets for staying knowledgeable.The IRS sometimes releases its official calendar a number of months earlier than the beginning of the tax yr.

Whereas particular particulars for the 2024-2025 calendar will not be obtainable till nearer to the related time, we will look at potential areas of change primarily based on previous tendencies and present occasions. A comparability with earlier years’ calendars reveals patterns that may supply insights into attainable modifications.

Comparability of 2024-2025 Calendar with Earlier Years

Predicting exact adjustments to the IRS calendar is troublesome with out official bulletins. Nonetheless, primarily based on historic information, we will anticipate some minor changes to deadlines. For example, the tax submitting deadline could shift barely relying on the day of the week on which April fifteenth falls. If April fifteenth is a weekend or a vacation, the deadline is usually prolonged to the following enterprise day.

Important adjustments are much less frequent, typically ensuing from main legislative actions. For instance, the passage of the Tax Cuts and Jobs Act of 2017 led to substantial adjustments in tax charges and deadlines, necessitating calendar updates. A comparability of the 2024-2025 calendar with earlier years will primarily give attention to such minor date changes associated to weekend or vacation occurrences.

An intensive comparability will solely be attainable as soon as the official IRS calendar is launched.

Assets for Up-to-Date Info

Probably the most dependable supply for the official IRS calendar is the IRS web site itself (irs.gov). The web site sometimes publishes the calendar nicely upfront of the tax yr. Tax professionals and accounting corporations additionally ceaselessly present updates and analyses of the calendar, providing interpretations and steering. Subscribing to IRS e mail alerts or following their social media channels can present well timed notifications of any adjustments or updates.

It’s essential to depend on official sources to keep away from misinformation.

Elements Influencing IRS Calendar Modifications

A number of components can affect modifications to the IRS calendar. These components vary from legislative changes to technological enhancements and unexpected occasions.

- Legislative Modifications: New tax legal guidelines or amendments to current legal guidelines typically necessitate adjustments to deadlines and submitting necessities, immediately impacting the IRS calendar.

- Technological Developments: Enhancements in tax processing techniques may result in changes in deadlines or the introduction of recent digital submitting choices, influencing the calendar’s construction.

- Unexpected Circumstances: Main occasions, resembling pure disasters or nationwide emergencies, could necessitate short-term extensions or changes to deadlines.

- Workload Administration: The IRS could modify deadlines to higher handle its workload and guarantee environment friendly processing of tax returns. That is much less frequent however can happen in response to important shifts in submitting patterns or technological challenges.

- Vacation Shifts: The position of holidays on or close to key tax deadlines often causes minor shifts within the official calendar to accommodate for weekend or vacation extensions.

Visible Illustration of the IRS Calendar

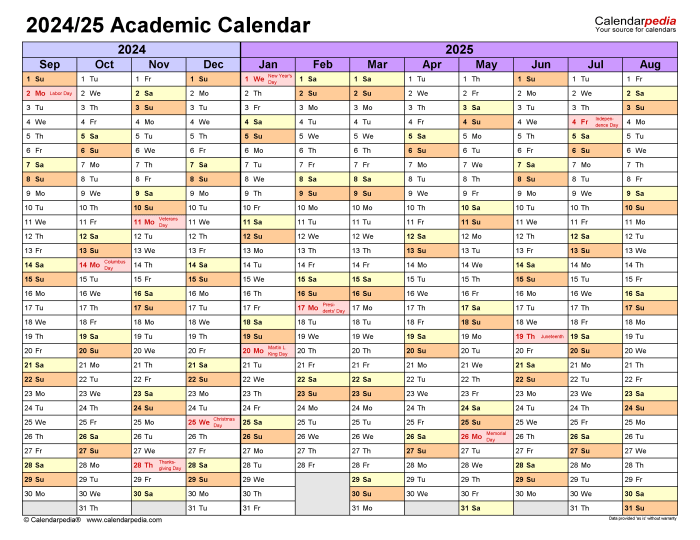

A well-designed visible illustration of the IRS calendar for 2024-2025 considerably enhances understanding and accessibility in comparison with a purely textual format. By using visible cues, key dates and deadlines turn into instantly obvious, lowering the chance of missed obligations.A visible calendar ought to prioritize readability and ease of navigation. This may be achieved by a mix of strategic color-coding, informative icons, and a logical structure.

Visible Calendar Design

The calendar may very well be introduced as a big, vertically oriented chart. Every month would occupy a definite part, probably utilizing a distinct pastel shade for every month to tell apart them visually. Key dates, resembling tax submitting deadlines, quarterly estimated tax funds, and different necessary IRS dates, could be highlighted with a daring, contrasting coloration, resembling a deep blue or vibrant inexperienced.

Every highlighted date could be accompanied by a small, simply identifiable icon. For instance, a small calendar icon may characterize tax submitting deadlines, a greenback signal icon may characterize fee deadlines, and a magnifying glass icon may characterize necessary informational releases or updates from the IRS. The textual content accompanying every date could be concise and clearly seen, utilizing a sans-serif font for readability.

The structure ought to be uncluttered, with ample white house to stop visible fatigue. The whole calendar may very well be simply printable for handy reference.

Advantages of Visible Illustration

Visible calendars supply a number of key benefits over textual representations. They supply a extra intuitive and quick understanding of necessary dates and deadlines. The usage of color-coding and icons permits for fast identification of crucial data, lowering the time spent looking by dense textual information. This visible method is especially helpful for many who usually are not aware of tax laws or discover it troublesome to course of giant quantities of textual data.

Moreover, a visible calendar serves as a extra participating and memorable software, rising the probability of compliance with IRS deadlines.

Different Visible Codecs

Infographics present a concise abstract of essentially the most essential IRS deadlines for the yr. They are often designed to focus on key tax obligations for various taxpayer classes (people, companies, and many others.), making them significantly helpful for fast reference. An infographic may use a timeline format to visually characterize the sequence of tax-related occasions all year long, making it simpler to grasp the general tax calendar.Interactive calendars, accessible on-line, supply even larger flexibility and performance.

Customers may filter the calendar to show solely related dates primarily based on their particular tax scenario. For example, a self-employed particular person may filter the calendar to indicate solely deadlines associated to estimated tax funds. Interactive calendars may additionally incorporate hyperlinks to related IRS publications and kinds, offering quick entry to extra detailed data. This dynamic method fosters a extra customized and user-friendly expertise.